The main tax incentive for electric vehicles (EVs) in Virginia, if you are considering buying a Tesla, lies in the federal government, not entirely in Northern Virginia yet.

Here’s how it generally works:

Tesla Electric Vehicle (EV) Federal Tax Credit

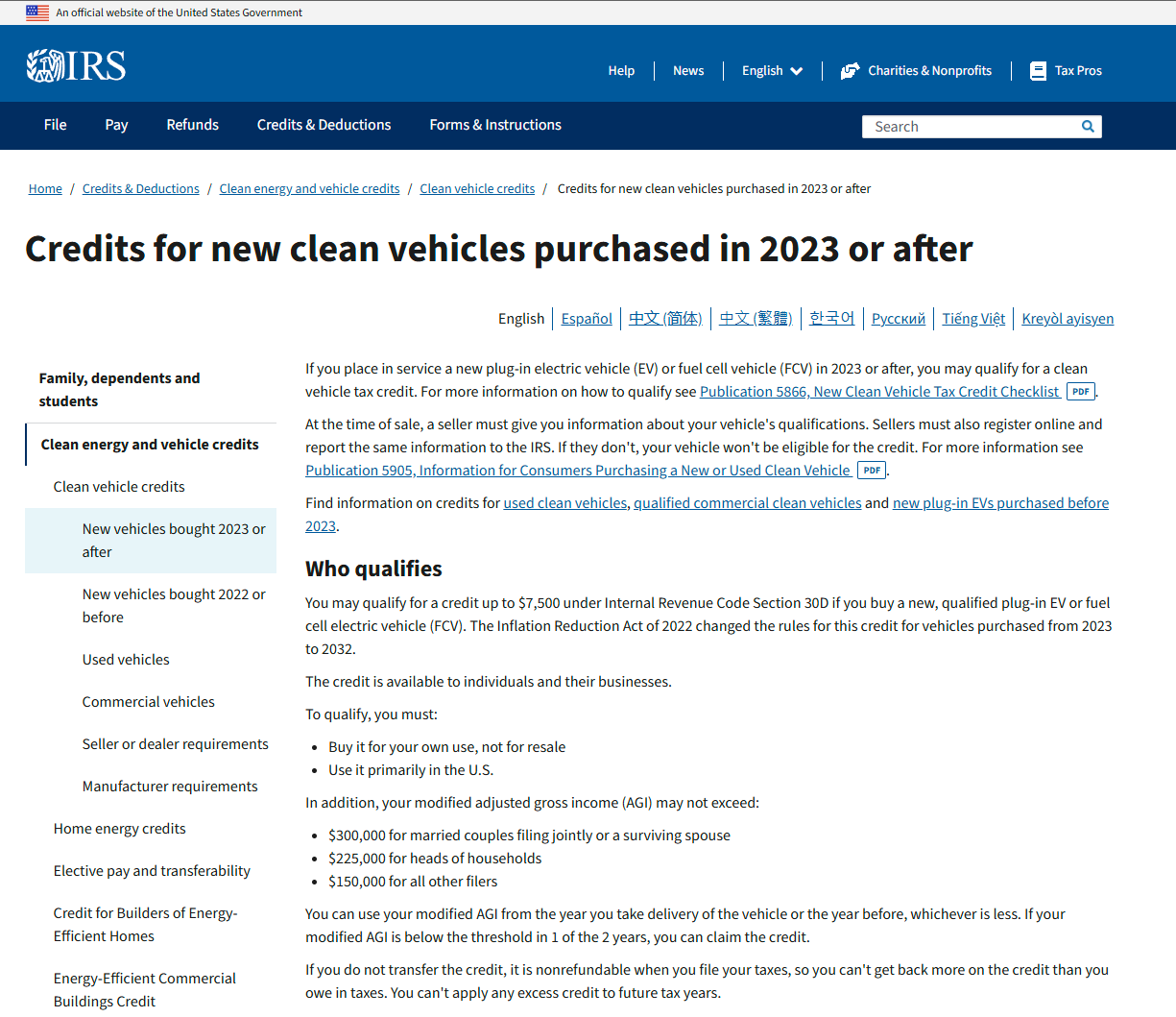

With the current federal program, eligible new Teslas could receive a federal tax credit of up to $7,500.

This figure can vary based on the model and specific criteria, such as battery components and final assembly location.

For most recent Tesla Model 3 and Model Y purchases, the full $7,500 federal credit often applies.

However, verifying this with Tesla’s website or the IRS’s official guidance is wise before deciding.

Remember that this is a nonrefundable credit, which will reduce your federal tax liability, but you won’t receive a refund if the credit exceeds what you owe.

Virginia State-Specific EV Incentives

Virginia has an EV rebate program but hasn’t funded it.

They would rebate buyers that buy a new (basis $55,000 or maybe less) or used EV (sale price $25,000 or even less) a $2,500 rebate.

Those above certain thresholds might get another $2,000 in rebates on qualified new or used EVs.

View Fairfax County updates right here: https://www.fairfaxcounty.gov/environment-energy-coordination/electric-vehicles

The direct monetary incentive will primarily come from the federal tax credit.

See if your local electric utility in Virginia provides some rebates or incentives for EV buyers.

Others give credit for installing EV charging stations at home, or they might provide EV rates, which save you money later on.

Additional EV Charger Considerations:

While Virginia may not offer direct EV purchase incentives, a few perks remain to consider.

For example, Virginia has developed its EV charging infrastructure and continues to support clean transportation initiatives.

Another consideration is to install a Tesla EV Charger inside your home.

Next Steps:

Before committing to a Tesla purchase, it’s a good idea to:

- Check the Latest IRS Guidelines: The rules around federal tax credits can change. Confirm current eligibility on the official IRS website or by consulting a tax professional.

- Visit Tesla’s Official Website: Tesla regularly updates incentive information for each model.

-

Tesla Model S

-

Tesla Model X

-

Tesla Model 3

-

Tesla Model Y

-

Tesla Cybertruck

-

Tesla Roadster (Next-Generation)

-

Tesla Semi

-

- Explore Local Utility Programs: Contact your utility provider to see if they have any ongoing rebates or special EV-related programs.

By combining the federal tax credit with any local utility incentives (when available) and the inherent efficiency of driving electric, you can position yourself to save money in the long run while enjoying the innovative technology Tesla has to offer.

Do you want to know the cost of installing your Tesla EV Charger at your home?

Send us a request, and we will give you the estimate on the same day.